The industrial project of the royal holding company Al Mada and the Chinese company CNGR is gradually taking shape. Announced last September, this gigafactory specializing in the manufacturing of battery components for electric vehicles is the subject of little but significant communication from the royal holding company and the Chinese industrial giant.

Last November, CNGR’s head of Europe’s division was the first to sing the praises of both the project and its partner in an interview with Le Point Afrique. « Al Mada is working towards the emergence of a modern economy (…), with long-term development goals. This fits in perfectly with CNGR’s perspective, which is to build global supply chains for battery materials« , Thorsten Lahrs asserted in the columns of the monthly magazine, where he also highlighted the geographical location and pricing advantages offered by setting up a plant in the Kingdom.

« Morocco is the ideal place to get closer to North America and Europe, thanks to the free-trade agreements in place« , affirmed Thorsten in the interview which was published before Joe Biden announced his intention to tax Chinese production as part of his economic war against China.

Last January, Le Desk also revealed the names of the new top management team of the joint venture, which is 50.03% owned by the Chinese company and 49.97% by the royal holding company. At the head of this joint venture is Jing Deng, a member of the Chinese company’s board of directors. At his side, as vice-chairman of the board, is Al Mada’s CEO Hassan Ouriagli.

At a meeting organized in mid-May by the Federation of Chemistry and Parachemistry (Fédération de la chimie et de la parachimie), Zineb Zeryouhi, the project’s general deputy manager, provided further details on the Gigafactory, including revelations on production, commissioning and the plant’s stated objectives.

CobCo, a complete ecosystem

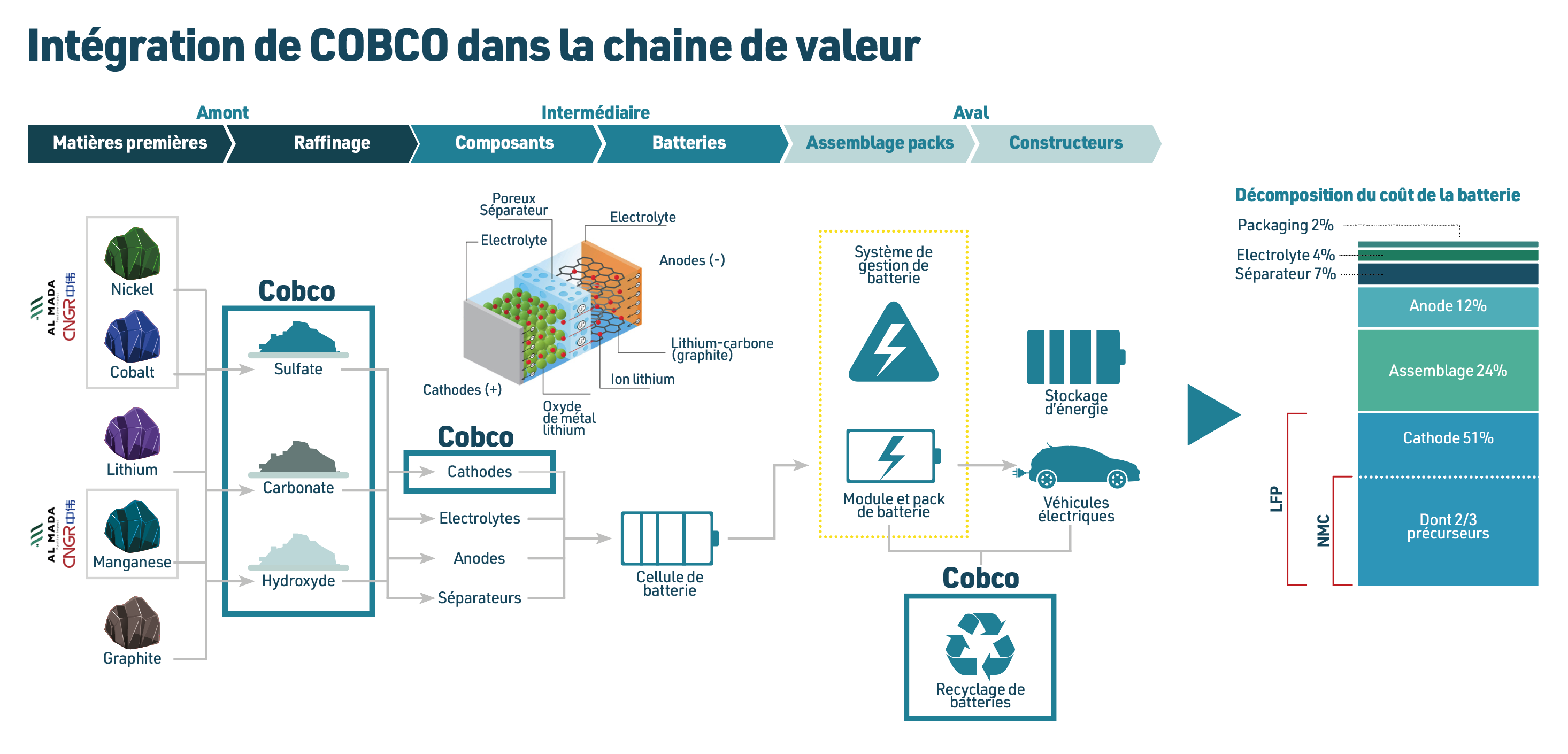

The Moroccan-Chinese gigafactory has a name, CobCo, which stands for Core Battery Components. It will spread over 200 hectares in the Jorf Lasfar industrial park near the OCP industrial complex, with the aim of creating a complete upstream and downstream ecosystem for the production of batteries for electric vehicles. To achieve this goal, the Gigafactory will house three industrial projects.

The first, currently under construction, will produce NMC (nickel, manganese, cobalt) precursors, used in the manufacture of cathodes for lithium batteries, currently the most efficient and common technology on the electric battery market. This first section of the Gigafactory is scheduled to be functional in January 2025.

The second project will produce LFP (lithium iron phosphate) cathodes, a less efficient but highly promising technology. « NMC batteries, although expensive, are very efficient, while LFP batteries, which are less expensive, are less efficient, but crucial to meeting global ambitions for electric mobility. We opted for both technologies, as the development of the Moroccan automotive industry requires a competitive battery ecosystem to access European and American markets in particular« , explains Zineb Zeryouhi.

25% of the Western market

European and American markets played a role in the decision making behind the Moroccan-Chinese joint venture. CobCo’s ambition is to capture 25% of the target markets of Europe and the United States. Not an unrealistic goal, given that CobCo will be able to draw on CNGR’s solid experience in the lucrative market for electric battery components. The Shenzhen-based company controls 23% of the global market share in its segment, generates $3.1 billion in sales and counts industry leaders such as Tesla and LG Chem among its customers.

Al Mada also points out that CobCo will be able to benefit from the various free trade agreements ratified by Morocco. However, « without precursors manufactured in Morocco, it will be very difficult for batteries or electric vehicles produced in Morocco to reach the integration rate required for free trade agreements with the United States and the European Union », reads the project presentation.

Focus on recycling

In addition to these geographical and political considerations, the resource factor has also been taken into account. CobCo will produce 120,000 tonnes of NMC precursors and 60,000 tonnes of LFP annually. To ensure this level of production, as well as the extraction and refining of the raw materials required for these two projects, CobCo will rely on « sister » companies, notably Managem, a subsidiary of Al Mada. As a majority shareholder in the mining group, the royal holding will be able to leverage synergies in local sourcing to optimize production chains and cut costs.

CobCo’s third industrial project will focus on the downstream part of the value chain, with the recycling of black mass which is a powdery black mass of lithium, cobalt and nickel, obtained by recycling used batteries or by the residues left over from their manufacture. Its use reduces dependence on primary resources, while reducing the carbon footprint associated with refining. 30,000 tonnes of black mass will be recycled annually by CobCo.

Getting a share of the pie

Morocco, hub of the African automotive industry, with over a million vehicles exported every year, is now firmly established in the value chains of the electric automotive industry and the global lithium battery market, which is expected to exceed $440 billion by 2030. Cobco’s direct competitors have already established a presence in the kingdom. Seeking proximity to the European market, these manufacturers, mainly Chinese, are increasingly investing in Morocco.

Among them is China’s BTR, whose 3 billion dirham Moroccan plant is currently under construction in the Mohammed VI Tanger Tech industrial zone, with a projected annual production capacity of 50,000 tonnes of cathodes.

The two groups will also have to compete with Shinzoom, which on May 14 signed a 4.6 billion dirham investment agreement to build its anode plant at Tanger Tech, also scheduled to be fully functional in 2025.

Since its effective launch in February 2023, no fewer than 14 investors have confirmed their arrival in the Tangier industrial hub.

Our sources say that two new industrial groups will set up before the end of this year: American equipment manufacturer Aptiv in June, for an investment of almost 4 billion dirhams, and Chinese tire manufacturer Sentury Tire in December, for an investment of 3 billion dirhams.

Written by Safae Hadri, edited in English by S.E.